African Claim Services

Who is African Claim Services

There has been a dramatic increase in the need for technical assistance in the marketplace over the last few years when dealing with Insurance related claims. This extends to the formulation of losses and pursuit of such losses, not only in terms of existing Insurance Policies in place, but general recovery claims against third parties once a loss has been suffered.

Considering the costs and time involved in formal litigation, there has been more and more of a demand for the project management of claims and assistance in pursuing a claim against insurers, at least up to and before the stage of formal litigation, should it be required.

ACS aims to provide:

- Technical assistance to insured entities in correctly and accurately formulating and presenting claims in terms of existing insurance policies in place.

- Assistance in the formulation and general calculation of losses, as well as the collating and compiling of substantiation as required when presenting a formulated claim to an insurer.

- Project managing recovery action, in respect of such losses against a party who caused the loss.

African Claim Services also provide technical Insurance assistance, training and workshops.

How ACS can assist you:

- Insurance claims are assesed by a loss adjuster, who is appointed by the insurer.

- It is up to the claimant to formulate and present their claim, often without assistance.

- Claimants are usually not aware of all the policy nuances and entitlements, this is where an experienced claims preparer will assist the claimant in obtaining the best possible settlement.

- The claimant's business must continue and resources required to prepare and justify the claim can take management away from operations at crucial times.

- The claims preparer will project manage the entire process.

ACS Directors

Stefan Terblanche (Managing Director)

B Juris, Dip Legum; LLB; Associate Member of the Institute of Loss Adjusters of SA (AILA); Fellow of the International Adjuster's Association (FIAA)

Stefan has previously served as a member of the national management team of GAB Robins and also on the National Executive of the Institute of Loss Adjusters of South Africa (ILASA) as the National President, currently again serving on the exco.

He has been adjusting since 1989, during which period he has attended to a wide range of claims from fire, products related, agricultural chemicals, animal feed lines and defective workmanship liability, as well as the general type of liability claims, including professional indemnity matters. He is one of the few adjusters in the country who regularly deals with product recall, product guarantee and product inefficacy claims. He has also been involved in several contamination and environmental claims over the years.

Stefan mostly deals with large loss, multi million Rand claims and/or claims of a technical nature. In respect of the latter, he also regularly provides technical workshops/presentations for several insurers and also for the Insurance Institute of South Africa, the Insurance Institute of Namibia and the Institute of Loss Adjusters of Southern Africa.

David Warburton (Director)

B Compt (Hons), Associate Member of the Institute of Loss Adjusters of SA (AILA)

After completing his articles in 1992 David held various financial management positions in both the manufacturing and service sectors. Past employers include multinationals such as Ford Motor Company and Johnson & Johnson.

His insurance career began in 2002 at Alexander Forbes Risk Services. Here he consulted on large and complex claims as well as advising clients on the placement of business interruption insurance. During this time, he consulted to many large corporates as well as clients in Africa.

David joined Specialist and Commercial Loss Adjusters during 2012 and The African Adjusting Firm in March 2015 to become part of our large loss/complex claims team.

David specialises in the financial aspects of claims such as business interruption, which is often an exceptionally technical part of large losses, involving loss of profits, increased costs and other complications. He also attends to financial type losses such as, fidelity guarantee, bankers blanket bond and quantification of civil claims.

Why use a Claims Preparer?

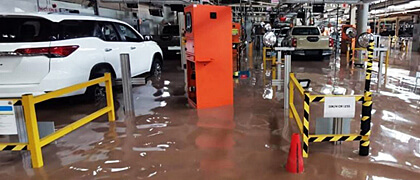

When an insured loss is suffered, most entities will discover that they are not necessarily geared for or experienced to calculate and assess either the required loss nor the collating of substantiation required to eventually present a quantified loss to their Insurer. Smaller entities may merely not have the in-house expertise whereas larger entities, whilst they may well have such in-house expertise, may have time constraints as well as man-power allocation issues.

African Claim Services has the expertise and experience of having dealt with a large number of claims involving a range of commercial enterprises and industries, loss calculations etc. over a number of years and will be able to assist any entity in respect of the above, specifically (but not limited to) the compiling and presenting a claim in terms of an existing insurance policy in place.

The insurance loss adjuster appointed by the insurance company, although well qualified and experienced, is not tasked to compile, quantify

and substantiate the claim, instead focuses on verifying the actual claim submission (to be compiled and submitted by the insured/you) and confirming that the claim, as submitted, falls within the policy cover in place.

As your claims preparer, we act as your advocate to focus on obtaining what you are entitled in terms of the policy in place, ensuring that the claim is correctly quantified and substantiated and also, presented against the correct insurance policy sections. We operate on a contingency basis, consequently, we will be with you throughout the process, assisting, formulating, submitting the claim and project managing the process with no charge until the insurance company settles the claim.

African Claim Services aim to provide:

- The technical assistance in correctly and accurately formulating and presenting claims in terms of existing insurance policies in place;

- Assistance is provided in the general calculation of losses as well as the collating and compiling of substantiation required in presenting a formulated claim, whether that is a claim being pursued against an insured in terms of an insurance policy in place or, alternatively, against a third party who caused a loss to the insured client. (Where perhaps that claim does not fall within the ambit of an existing insurance policy in place);

- And then also, project managing the recovery action in respect of any such losses against the third party who caused the loss, if and where applicable or necessary.

Contact African Claim Services

Business Enquiry